Most of us can appreciate the importance of having money. We need money to be able to buy the things we need. We work to earn money and if we are prudent we save some for times of need.

Money is both convenient and necessary for efficient exchange of goods and services. While bartering and the simple exchange of gifts are the basic means by which humans can trade goods and services, using cash is universal and convenient.

The fundamental objective of any business enterprise is to a make a profit. If a business cannot return a profit that business would very soon… well, be out of business. Similarly, as individuals, we all desire to save some money for a rainy day.

How can we all make a profit and prosper? Where does the money come from to pay for profit? For each individual and each successful business to save or realize a profit, the money supply must continually grow. Home-owners, businesses, corporations, towns, cities, municipalities and governments all require an expanding money supply in order to grow, build infrastructure and to be able to flourish.

In reality, money is created through debt. Banks issue loans to individuals, businesses, corporations, towns and cities to enable them to build infrastructure and improve productivity. Loans are investments into a more productive future.

Loans are essentially accounting entries on a computerized record. Loans are repaid by ongoing productivity of workers and corporations alike, by shifting the debt to the next layer of loan recipients. The issuance and repayment of loans is simply a grand pyramid scheme. In addition, the bank makes a profit from the interest which comes from the creation of additional loans.

Ideally, an expanding money supply ought to be reflected in increased real wealth such as surplus, assets, infrastructure or investment. In reality, this is not the case. Money created is an entitlement on future goods and services and hence is a debt on future workers. The working class becomes indentured to the money holders, labouring in servitude of the ruling class. Moreover, excessive creation of money dilutes the value of money and directly leads to inflation.

When there are hundreds of billions of dollars at stake in what has become a ultra-high risk poker game, where billions of dollars of corporate assets, retirement and pension funds are on the line, fund managers resort to very complex strategies involving the brightest minds in mathematics, physics, chaos theory, cybernetics and super computers. It becomes purely a strategy of gamesmanship, trying to outsmart the competition.

(The widespread belief that in financial markets for every winner there is a loser is not accurate. One has to take into account the fact that the money supply is continuously increasing.)

In summary, our current economic system depends on continual growth of money creation via the issuance of loans. Economic growth depends on continual increase of the money supply, markets and consumption. The sad reality is that money created is more easily amassed by the ruling class, the corporations and the wealthy. The gap between the rich and the poor continues to widen.

In addtion, expanding markets and consumerism require the liquidation of our natural capital, depletion of natural resources and destruction of the environment... all for the sake of profit.

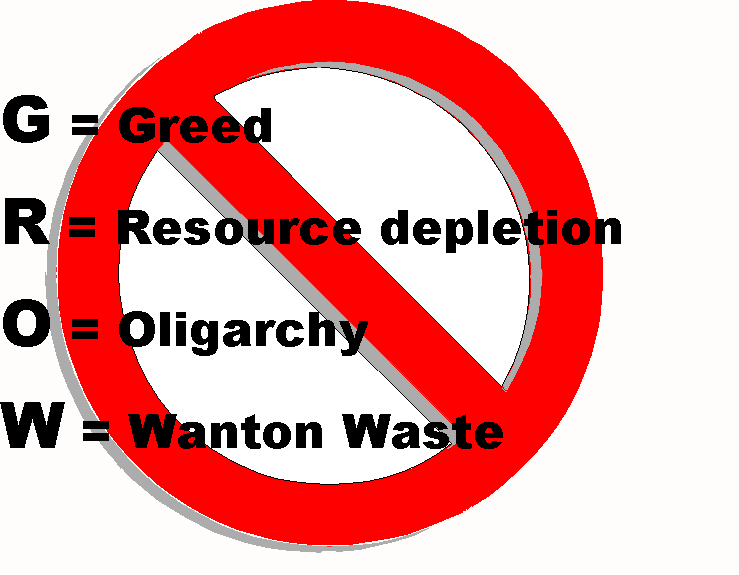

In a nutshell, GROW is a dirty four-letter word.

| Creative Commons License | |

Contact | Privacy Policy | Disclaimer | 2008.04.04 - Updated 2014.08.05 |  |