The Steady-State Initiative

moving toward sustainability through economic reform

|

The Steady-State Initiative moving toward sustainability through economic reform |

| Home | Español | Français |

2011 July 30

Will the US default on the US dollar? What would this mean to the global financial system?

When an individual is so in debt sometimes the only way out of the quagmire is to declare personal bankruptcy. You default on all outstanding loans and relinquish all financial assets that you may hold. That is, you get the chance to start over from scratch. Your creditors such as the mortgage holder and credit card companies, i.e. the banks, absorb your outstanding debt as a business loss and write them off their books. For a small fry customer such as a private individual, this is no great loss to the bank and it is all factored in as part of the cost of doing business.

For a large entity such as the U.S.A., this is a much different story. The US Govt. running out of cash means it cannot pay its bills and has to increase its debt load. One way of fullfilling its financial obligations is to sell off public property and assets, i.e. privatization. Private individuals and corporations gain more control of the commons. Another way of reducing the debt load is to devalue the dollar or default all debt. That is to say that any outstanding US dollars would from henceforth be worthless. That is hard to believe but it has occurred many times in the past in many countries around the world. See hyperinflation - Wikipedia. Besides, the US dollar is reserve currency - all international trade is conducted in US dollars and balance of trades are secured in US dollars.

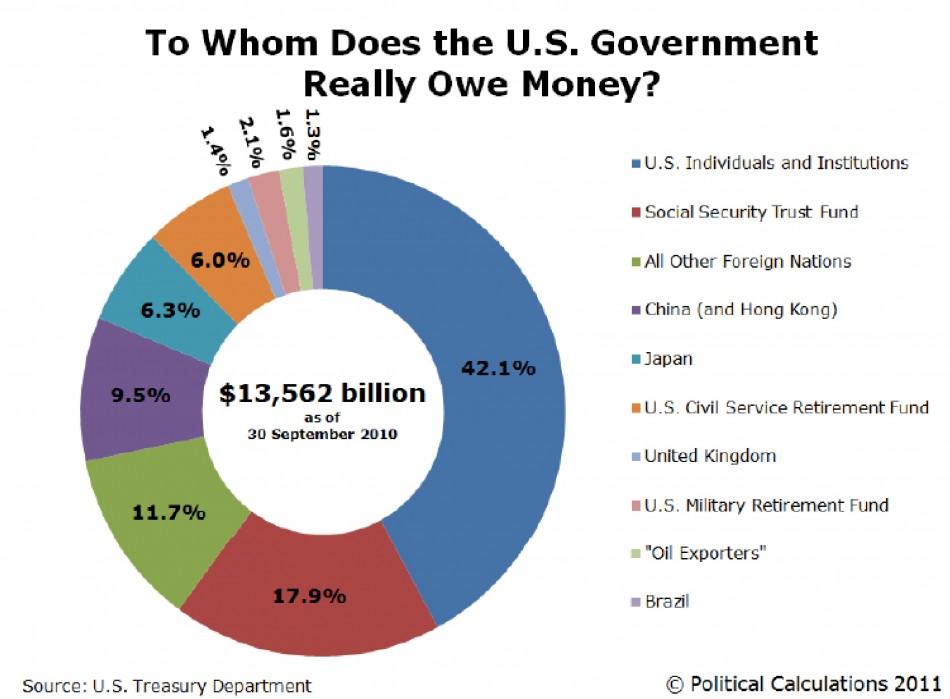

Let us examine who are the current holders of US dollars and US debt.

[1] http://www.ibtimes.com/articles/133998/20110413/who-holds-us-debt.htm

[2] Here are the top 15 holders of US debt in dollar amounts:

1 - Federal Reserve and Intragovernmental Holdings $5.351 trillion.

That's right, the biggest holder of US government debt is actually within the

United States. The Federal Reserve system of banks and other US intragovernmental

holdings account for a stunning $5.351 trillion in US Treasury debt. This is

the most recent number available (Sept 2010), and marks an all-time high.

2 - Other Investors/Savings Bonds $1.458 trillion.

With the most recent numbers from Sept 2010, this extremely diverse group includes

individuals, government-sponsored enterprises, brokers and dealers, bank personal

trusts, estates, savings bonds, corporate and non-corporate businesses.

3 - China $896b

4 - Japan $877b

5 - Pension Funds $706b

6 - Mutual Funds $638b

7 - State and Local Governments - $512b

US state and local governments have over a half-trillion dollars invested in

American debt, according to the Federal Reserve. That's the same amount of US

debt held by the United Kingdom.

8 - United Kingdom - $512b

9- Depository Institutions - $270b

This group includes commercial banks, savings banks and credit unions.

10 - Insurance Companies $262b

11 - Oil Exporters $210b

Included in the group of oil exporters are Ecuador, Venezuela, Indonesia, Bahrain,

Iran, Iraq, Kuwait, Oman, Qatar, Saudi Arabia, the United Arab Emirates, Algeria,

Gabon, Libya, and Nigeria.

12 - Brazil $184b

13 - Caribbean Banking Centers $146b

The US Treasury identifies this group as institutions in the Bahamas, Bermuda,

the Cayman Islands, Netherlands Antilles, Panama and the British Virgin Islands.

14 - Hong Kong $139b

15 - Canada $125b [3]

Will the US declare bankruptcy? That is unlikely because the domino effect would be catastrophic. Banks, mutual funds and insurance companies have too much to lose. Foreign countries such as China and Japan have too much at stake. Collapse of the global financial system would trigger a world war.

How do we reach a compromise by the looming deadline on August 2, 2011? The US Senate led by the Democrates will not pass a cost-cutting bill that does not include raising taxes on the rich. The US House of Representatives led by the Republications will not raise taxes on the wealthy and corporations. This impasse will result in President Obama unilaterally increasing the debt ceiling as the only remaining option.

The fact is, President Obama and the US is caught between a rock and a hard

place. There is NO solution to this crisis. Cutting social spending, raising

taxes, increasing the debt ceiling are all short term measures that only postpone

the inevitable.The immediate result will be a devalued US dollar, whether anyone

likes it or not. This will soften the pain for now but the worse is yet to come.

References:

[1] http://www.ibtimes.com/articles/133998/20110413/who-holds-us-debt.htm

[2] http://www.cnbc.com/id/29880401/The_Biggest_Holders_of_US_Government_Debt

[3] http://www.guardian.co.uk/news/datablog/2011/jan/18/us-federal-deficit-china-america-debt

| Creative Commons License | © 2008 Kenrick Chin | Home | Contact | Privacy Policy | Disclaimer | 2008.04.04 - Updated 2011.06.17 |